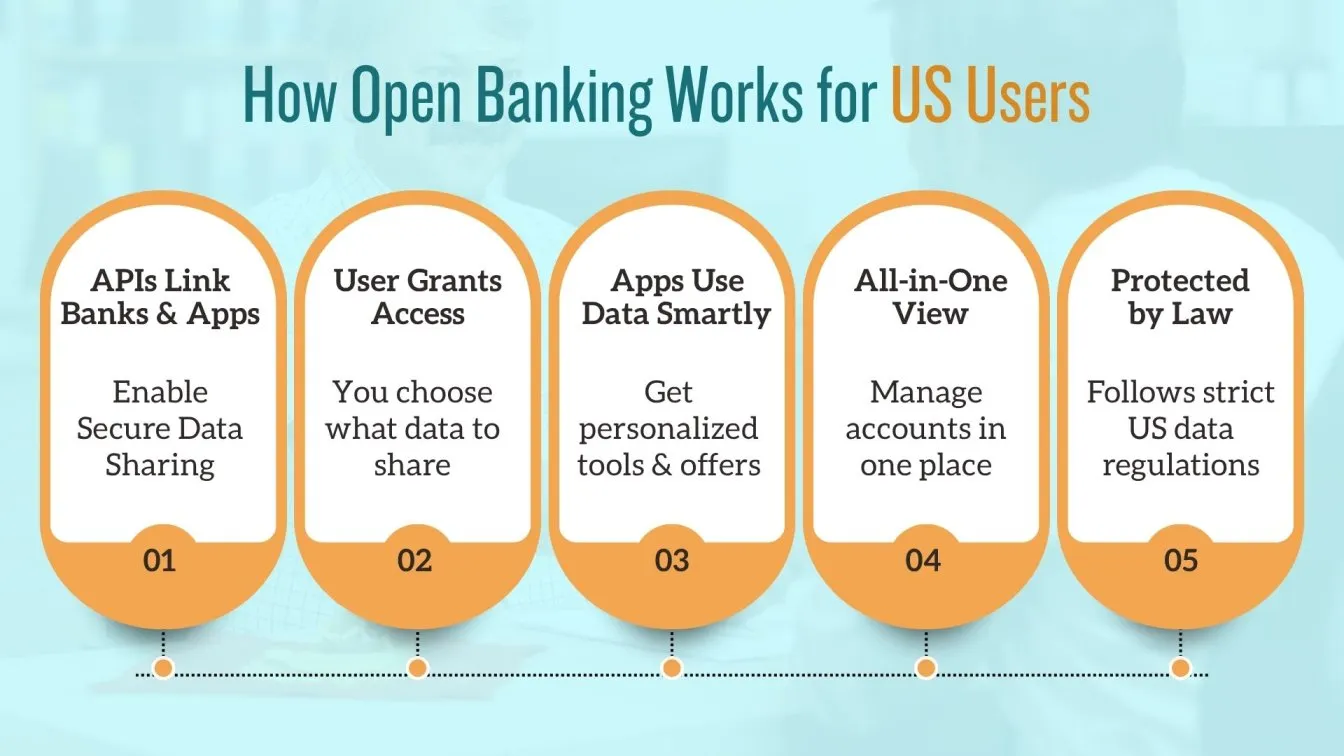

Open Banking is changing financial access for US consumers. Through a secure open banking platform, users can easily open online banking accounts and connect them with various fintech companies and apps. Using application programming interface (API) technology, this system allows safe data sharing while ensuring strong data security with advanced cloud data security solutions. Supported by US open banking regulation, the fintech industry and banking-as-a-service providers are creating new options in digital banking services. Open Banking gives Americans more control over their finances, making banking easier, faster, and safer.

What’s Next? Keep reading to discover:

🚀 What Open Banking Means for your finances, data control, and access to new services.

🚀 Simple Ways to Stay Secure while using open banking platforms and apps.

🚀 Key Risks to Watch For before sharing your data with third-party providers.

🚀 Top Benefits for US Consumers, from better financial insights to smarter offers.

🚀 Future of Open Banking in the US, including regulatory trends and fintech growth.

What Is Open Banking?

Open Banking is a system that allows banks to securely share customers' financial data with authorized third-party providers through application programming interfaces (APIs). This enables consumers to access a wider range of financial services, such as budgeting tools, loan offers, and investment platforms, all from their open banking accounts. In the US, open banking platforms are designed to increase transparency, improve financial access, and promote innovation in digital banking services while maintaining strong data security standards under US open banking regulation.

Key US Open Banking Regulations Include:

- Gramm-Leach-bliley Act (GLBA): Requires financial institutions to protect the private financial information of consumers and disclose their information-sharing practices.

- Consumer Financial Protection Bureau (CFPB) Guidelines: Sets standards for data privacy, consumer protection, and fair access in financial services.

- Federal Trade Commission (FTC) Regulations: Enforce rules against unfair or deceptive practices in data handling and sharing.

- Payment Services Directive (PSD2) Influence: Though PSD2 is EU-based, it inspires US frameworks promoting API security and customer consent in data sharing.

- State-Level Privacy Laws: States like California (CCPA) add layers of consumer data protection affecting how open banking data is handled.

Here are two examples of how it benefits users:

- Account Aggregation – Platforms like Plaid and Yolt allow users to connect multiple bank accounts, providing a single dashboard to track balances, transactions, and spending patterns.

- Instant Payments – Services like TrueLayer streamline transactions, enabling businesses and individuals to send and receive payments instantly without relying on traditional card networks.

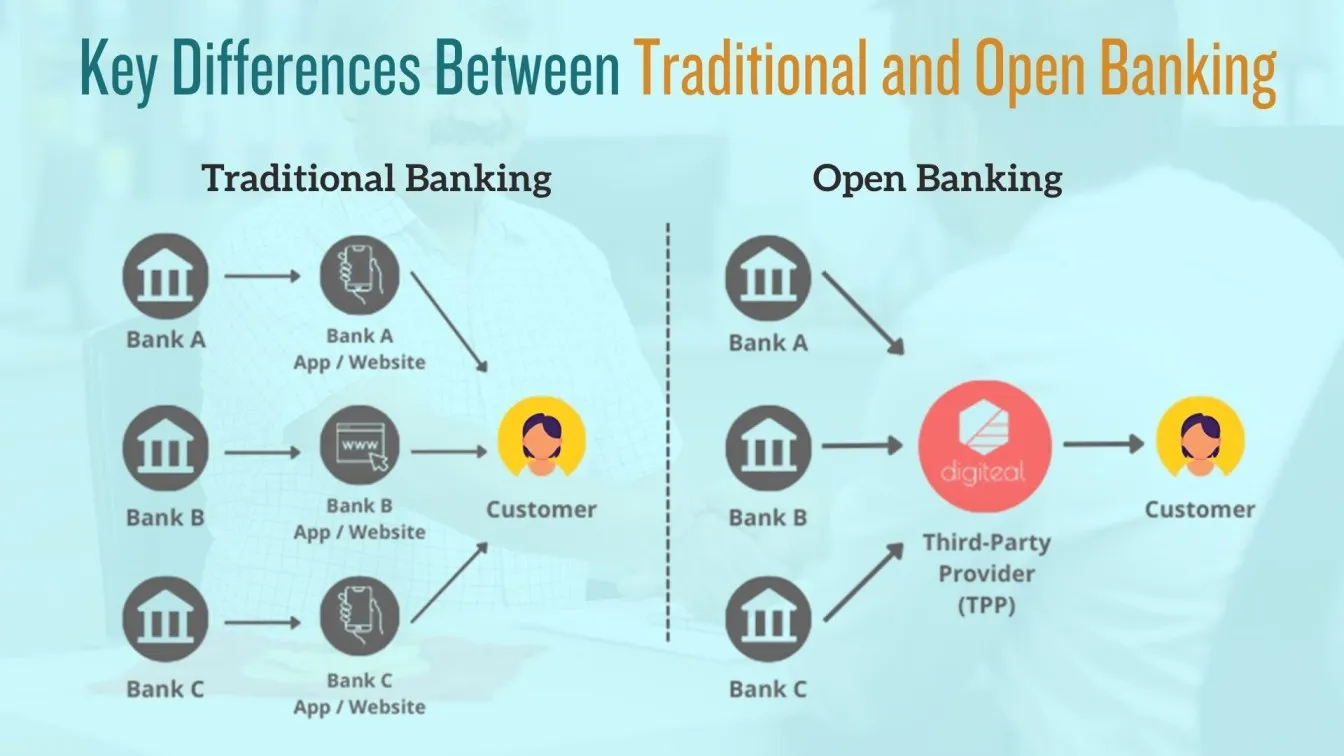

This diagram illustrates the difference between Traditional Banking and Open Banking.

- Traditional Banking: Customers interact directly with each bank (Bank A, Bank B, Bank C) through separate apps or websites, managing accounts individually.

- Open Banking: A Third-Party Provider (TPP), like Digiteal, acts as a bridge between banks and customers, offering a single platform to access and manage multiple bank accounts seamlessly.

In short, Open Banking simplifies financial management by allowing users to consolidate interactions with multiple banks into a unified experience.

How Different Countries Approach Open Banking:

These differences affect how securely and effectively consumers can access and share their financial data. Here’s a brief overview of key countries leading in Open Banking adoption:

🌍 Other Countries:

- 🇪🇺 The European Union has harmonized Open Banking through PSD2 across member states, promoting a competitive fintech environment.

- 🇮🇳 India utilizes its UPI framework and Account Aggregators to create an inclusive Open Banking experience, enhancing financial inclusion. Effective integration of the Unified Payment Interface payment system requires rigorous Application Programming Interface testing to validate transaction flow, data security, and system interoperability.

- 🇨🇦 Canada is testing a phased approach, balancing innovation with risk management.

- 🇸🇬 Singapore promotes Open APIs and robust standards through the Monetary Authority of Singapore, fostering fintech growth.

- 🇧🇷 Brazil is rolling out Open Banking in stages with mandatory compliance, making it one of the most structured implementations in Latin America.

Consumers today can open an online banking account seamlessly through platforms powered by digital banking software and core banking as a service solutions. These innovations are made possible by fintech software development services that prioritize application programming interface security. With real-world application programming interface examples, such as connecting budgeting apps to bank accounts, users enjoy streamlined financial experiences. Meanwhile, data security services ensure that all security data remains protected during every transaction and data exchange.

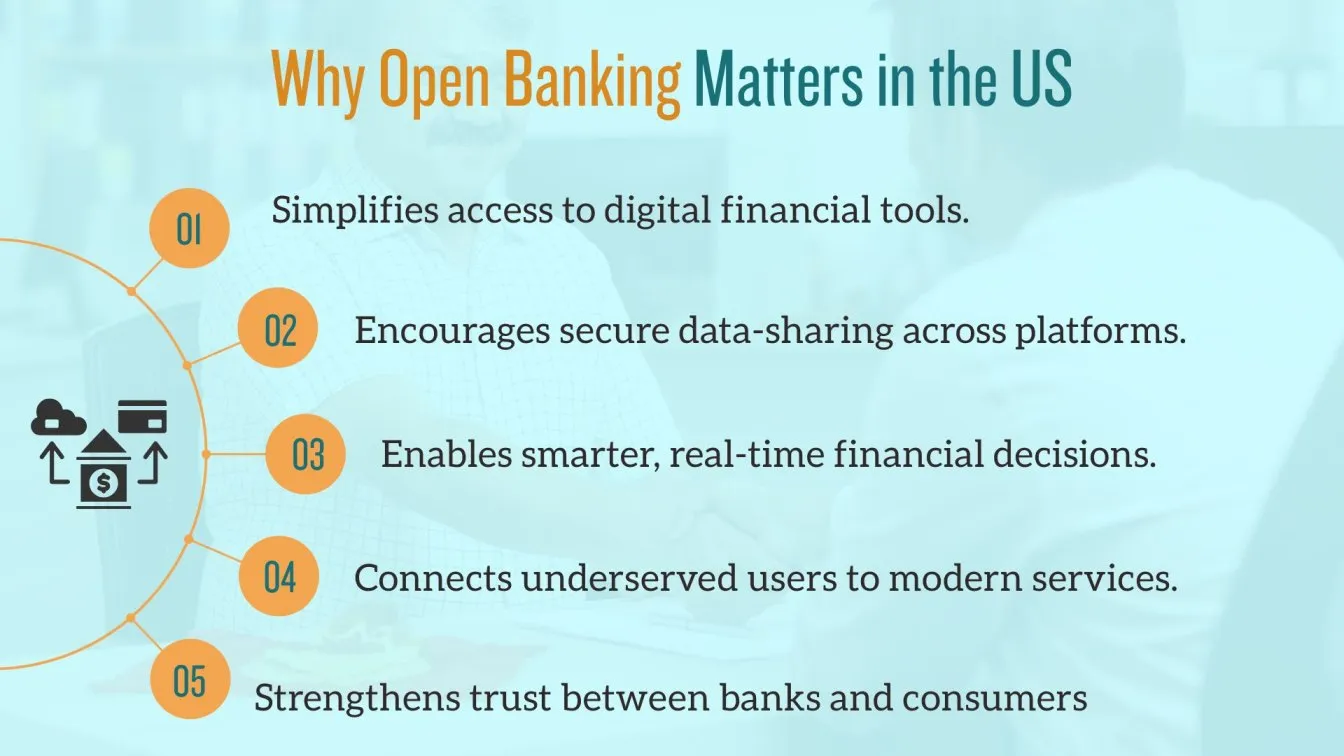

Benefits of Open Banking for US Customers

Open Banking is transforming how Americans manage their finances by offering better customer engagement, increased convenience, and access to innovative tools. Through secure platforms, customers in the US can benefit in multiple ways:

- Greater Financial Control: Open Banking enables users to connect multiple accounts and apps in one dashboard, offering a clearer view of their finances and encouraging informed decisions, a major shift in the financial services industry.

- Easier Account Setup: Seamless integration through APIs helps users quickly open and connect banking services without repetitive verification, supporting modern banking initiatives that prioritize ease and speed.

- Personalized Services: Based on financial behavior, third-party service providers can deliver customized offers on loans, savings, and investments, reshaping business models in the financial industry.

- Improved Access to Credit: Lenders can analyze real-time data to evaluate creditworthiness, helping more Americans qualify for fairer rates and better financial products.

- Innovative Digital Banking Solutions: Fintech firms and banking-as-a-service providers introduce budgeting tools, instant payments, and alerts, improving everyday financial management and customer engagement.

- Enhanced Data Security: While security risks exist, the US open banking regulation enforces strict controls to ensure encrypted data sharing and protect sensitive customer information.

- Financial Inclusion: Open Banking expands the reach of digital finance, allowing underserved groups to access essential services, supporting equity across the broader financial ecosystem.

Simple Methods to Keep Your Data Safe with Open Banking

Protecting your financial information is essential when using Open Banking services. Trusted banking institutions implement strong security measures to support safe data sharing and smarter financial planning across connected platforms.

1. Strong Customer Authentication (SCA)

Implementation:

SCA requires users to confirm their identity using two or more factors, such as a password, fingerprint, or a one-time code sent via SMS. This multi-factor approach adds an extra layer of security before you can access your open banking account.

Example:

When logging into a digital banking app, after entering your password, you may be prompted to verify your identity through a fingerprint scan or an SMS code, preventing unauthorized access even if your password is compromised.

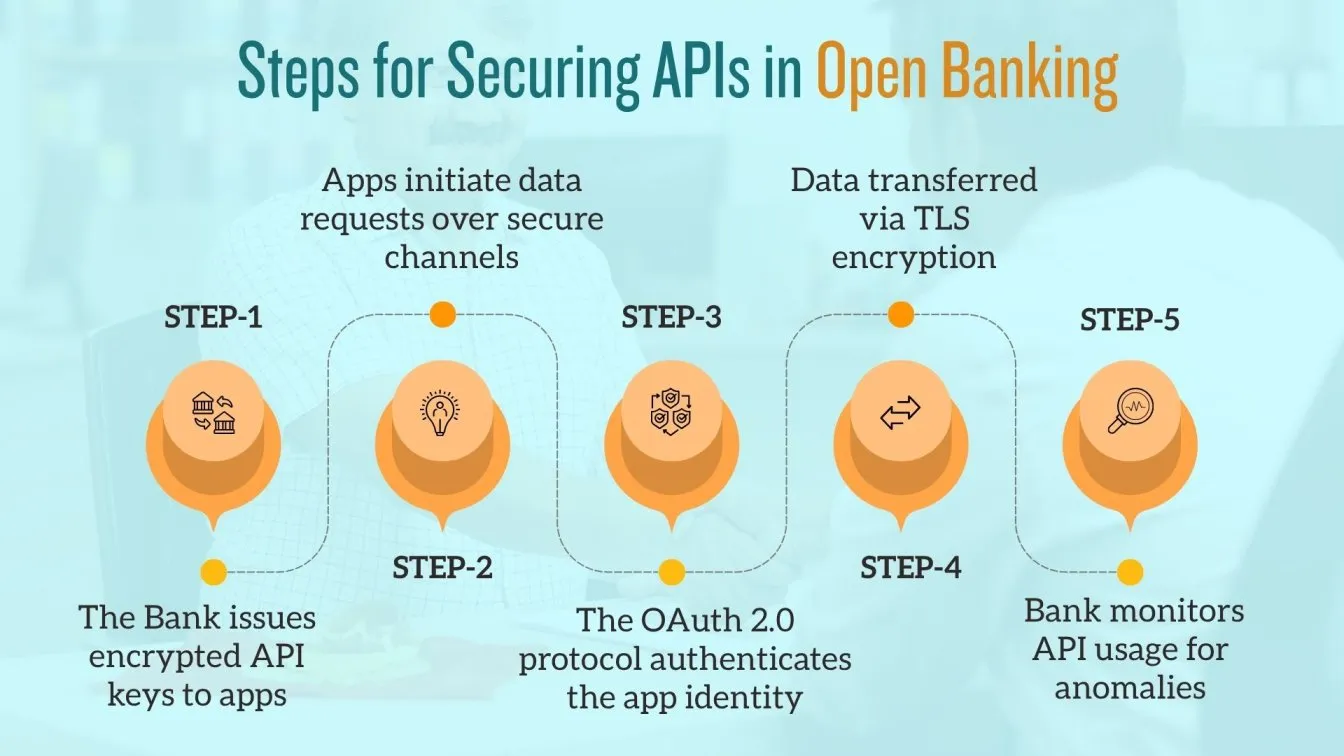

2. Secure APIs (Application Programming Interfaces)

Implementation:

Banks and fintech companies rely on secure APIs protected by encryption protocols like OAuth 2.0 and Transport Layer Security (TLS). These protocols encrypt data exchanged between your bank and third-party providers, preventing interception or tampering.

Example:

When you connect a budgeting app to your bank, the app fetches your transaction data through encrypted API calls, ensuring that sensitive information is transferred securely without exposure.

3. Data Encryption

Implementation:

Sensitive financial data is encrypted both in transit (when it moves between systems) and at rest (when stored). Advanced encryption algorithms make data unreadable to unauthorized users or cybercriminals.

Example:

Your transaction history and personal details stored on cloud servers or transmitted to third-party services remain encrypted, making it extremely difficult for hackers to access or misuse your information.

4. Customer Consent and Control

Implementation:

Open Banking platforms require explicit permission from users before any data sharing occurs. You retain full control, with the ability to review, manage, and revoke access for any connected services at any time.

Example:

You might authorize a loan service to access your banking data to evaluate your creditworthiness. Still, if you decide to stop using the service, you can revoke its access instantly through your bank’s app.

5. Regular Security Audits and Compliance

Implementation:

Banks and fintech companies follow strict US open banking regulations, conducting frequent security audits and vulnerability assessments. This ensures continuous improvement of their data security software and compliance with industry standards like PCI DSS.

Example:

A bank’s security team runs penetration tests and updates firewall settings regularly to patch weaknesses and keep your financial data protected from emerging threats.

6. Cloud Data Security Solutions

Implementation:

Many Open Banking providers use secure cloud infrastructures with advanced security features such as intrusion detection, encrypted storage, and strict access controls to defend against cyber attacks.

Example:

Your digital banking platform stores your data in cloud servers that monitor access in real-time and automatically block suspicious activities, ensuring ongoing protection.

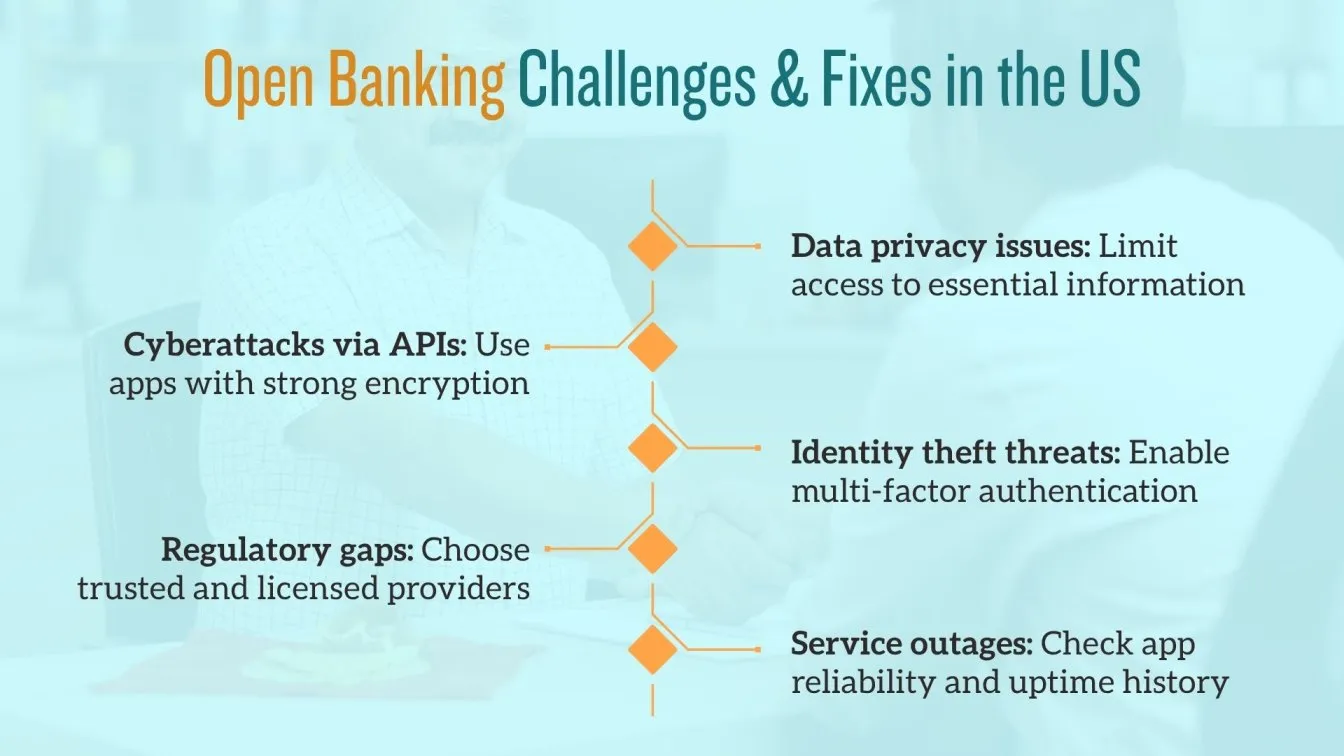

Key Risks Involved in Open Banking for US Customers

Open Banking introduces more flexible access to financial products and innovative services. Still, it also presents several risks that customers in the US must understand to safeguard their financial accounts and data within this expanding financial ecosystem.

1. Data Privacy Concerns

Sharing your financial information with multiple third-party service providers increases the risk of unauthorized access or misuse. Even with consent rules in place, some apps may collect excessive data, affecting your customer experience and privacy.

2. Cybersecurity Threats

The growing use of application programming interfaces (APIs) in banking systems heightens the risk of cyberattacks like phishing, data breaches, or hacking. Weak risk management by some fintech startups or banking software as a service providers can compromise customer data security and violate security requirements.

3. Fraud and Identity Theft

Criminals may take advantage of data-sharing features to impersonate customers, targeting weak banking frameworks to commit fraud or identity theft, ultimately affecting customer retention and trust in financial services providers.

4. Insufficient Regulation and Oversight

The current US open banking regulation is still evolving. Without uniform banking standards, there may be inconsistencies in how financial service providers handle customer data, leaving gaps in protection across the financial industry.

5. Technical Failures and Service Interruptions

Heavy reliance on APIs means system failures or downtime in a digital banking app or fintech backend can interrupt access to essential financial solutions, affecting customer service and overall customer satisfaction.

Conclusion: The Future of Open Banking in the US

Open Banking in the US is growing quickly, driven by fintech innovation and changing US open banking regulation. As more banks and fintech startups adopt secure open banking platforms, consumers will enjoy easier access to financial services and better control over their money.For this growth in digital finance to continue, strong data security and consumer trust remain essential. The future of consumer banking depends on seamless cooperation between banks, fintech companies, and regulators to ensure secure access to consumer financial data and reliable payment initiation services. With such collaboration, U.S. customers can confidently open online accounts and fully benefit from the expanding world of digital banking experiences.

Frugal Testing, a leading SaaS application testing company, is renowned for its specialized AI-driven test automation services tailored to meet the evolving needs of modern businesses. Among the comprehensive services offered by Frugal Testing are advanced Fintech Software Testing Services, designed to ensure security, performance, and compliance in financial applications. The company also provides cloud-based test automation services, enabling scalable, efficient, and cost-effective testing solutions for fast-paced digital environments.

People Also Ask

Is There a Sandbox Environment for Open Banking API Testing?

Yes, many banks and fintech companies provide sandbox environments where developers can safely test Open Banking APIs without using real customer data.

How Is Open Banking Different from Mobile Banking?

Open Banking allows third-party apps to access financial data via APIs, while mobile banking apps are controlled directly by banks for personal account management.

How Do Banks Verify Third-Party Providers in Open Banking?

Banks utilize strict regulatory guidelines and certification processes to ensure that only authorized providers have access to customer data.

Can Open Banking Help Me Switch Banks More Easily?

Yes, Open Banking facilitates seamless data transfer, making it simpler to switch banks without losing transaction history.

Is Open Banking Compatible with Cryptocurrency or Web3 Services?

Not yet fully, but some fintechs are working to link Open Banking APIs with crypto wallets and DeFi platforms for a smoother, connected experience.

%201.webp)