FASTag, based on RFID (Radio Frequency Identification) technology, enables automatic tolls payment by scanning RFID chips as vehicles pass through toll plazas. With millions relying on FASTag for car toll payment, maintaining speed and accuracy is critical.

These tests help detect issues in toll fee payment, prevent system failures, and support regulatory compliance. Testing also ensures secure processes for FASTag recharge, fraud detection, and toll payment options, ultimately delivering a seamless, efficient, and trustworthy experience for users across the FASTag system. This blog examines how FASTag operates, various testing types, challenges, and real-world examples that underscore the importance of thorough testing.

💡What’s Next? Keep reading to discover:

🚀 A quick look into FASTag’s end-to-end payment process

🚀 Why testing FASTag is crucial for speed and transaction accuracy

🚀 Key testing types: performance, functional, and compliance

🚀 Real FASTag failure cases, their causes, and effective solutions

🚀 Major challenges toll operators face in delivering smooth experiences

Introduction to FASTag Payment Systems

FASTag is a contactless electronic toll collection system introduced in India that uses RFID (Radio Frequency Identification) technology. It is linked to a prepaid account and affixed to a vehicle’s windshield, enabling automatic toll payments at toll plazas without requiring vehicles to stop. This not only promotes faster movement and reduces traffic congestion on highways but also supports the government’s push towards digital payments and smoother transportation infrastructure.

Why FASTag Testing Matters?

FASTag handles millions of transactions daily, making speed, accuracy, and compliance critical. Without testing, issues like failed deductions, duplicate charges, or tag-reader errors can disrupt toll operations and user experience. Testing ensures the system runs smoothly, securely, and meets standards.

Here’s why FASTag testing is essential:

- Validates system performance under high traffic using performance testing

- Detects fraud using advanced fraud detection software and simulations

- Maintains compliance with NPCI and NHAI guidelines

- Reduces toll delays caused by RFID misreads or tag misplacement

- Supports FASTag recharge verification and wallet integration for smooth payments

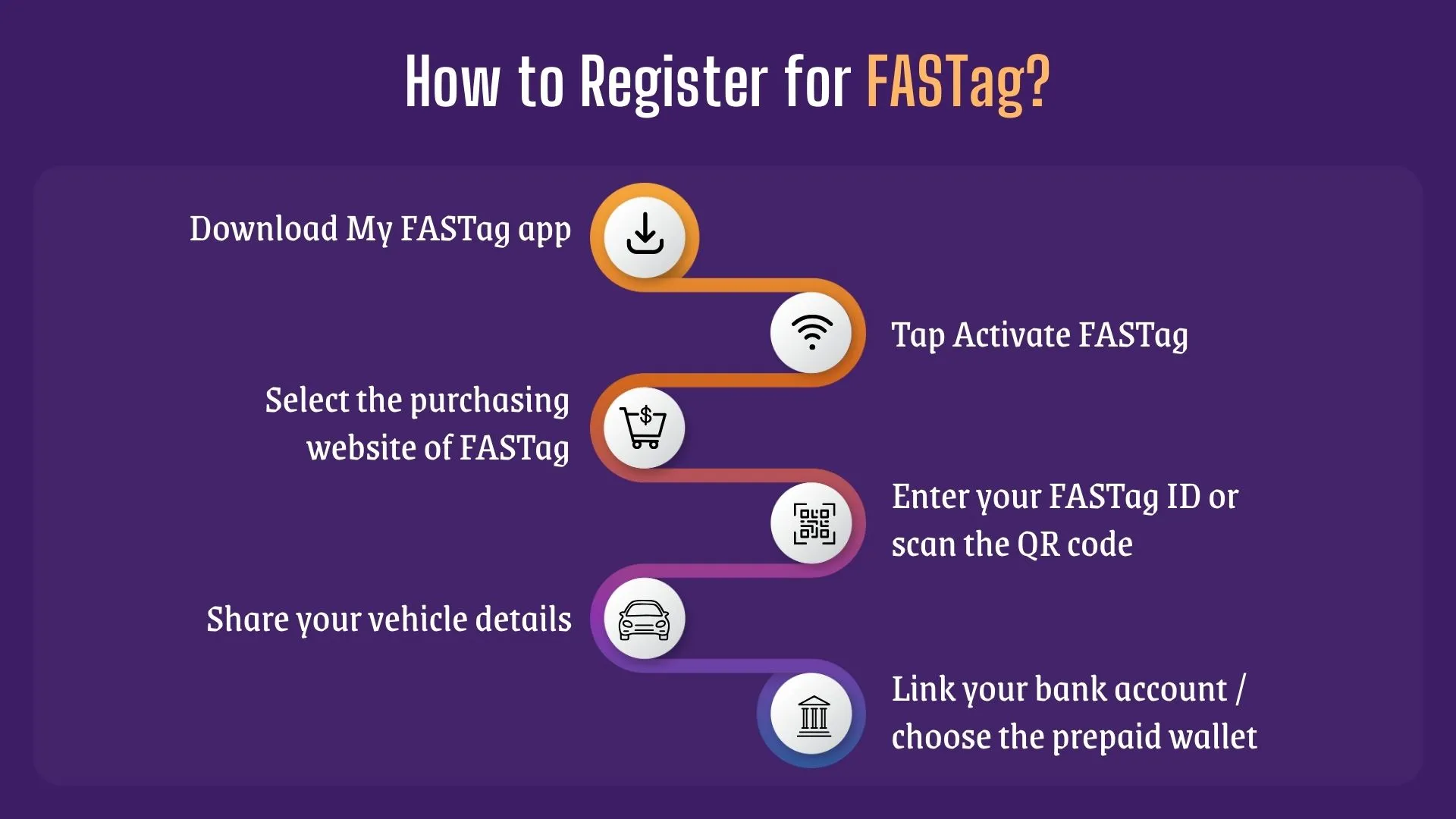

To ensure a seamless and secure experience, technology providers and FASTag issuers must streamline onboarding while maintaining reliability. Here’s a simplified breakdown of the registration process, crucial from a backend validation and integration testing perspective.

How FASTag Works: A Quick Overview

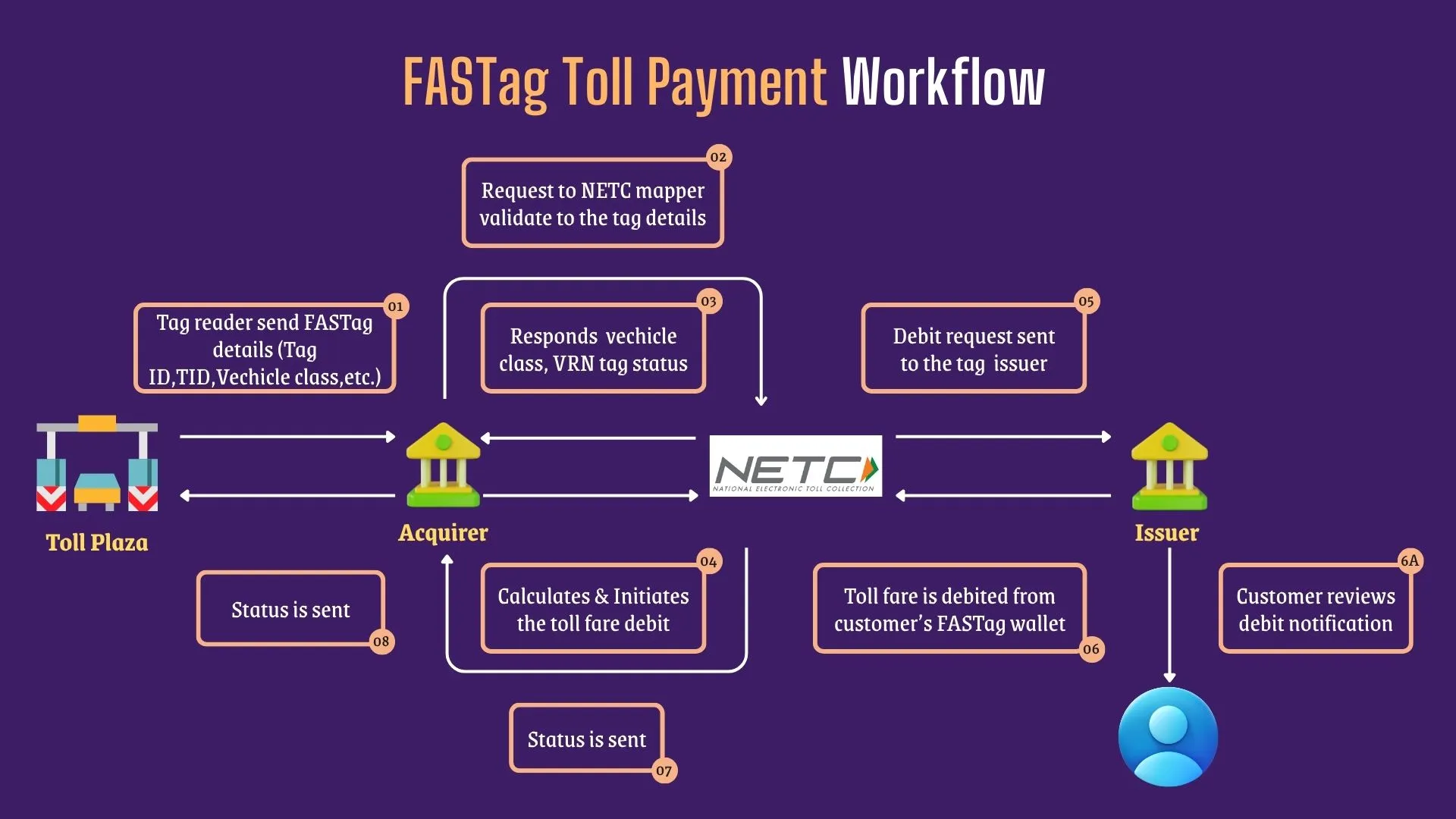

FASTag enables automatic toll payments via RFID technology under the NETC (National Electronic Toll Collection) system. As a vehicle passes, the RFID chip is scanned, triggering a digital process involving the toll plaza, acquirer bank, NETC, and issuer bank.

The process can be broken down into the following steps:

- Tag Reader Sends FASTag Details

- At the toll plaza, the RFID reader scans the FASTag.

- It captures details like Tag ID, TID, Vehicle Class, and Vehicle Registration Number (VRN).

- Request Sent to NETC Mapper

- The acquiring bank forwards this data to the NETC Mapper.

- The Mapper validates the tag and maps it to the issuing bank.

- NETC Responds with Tag Details

- NETC returns the mapped vehicle class, VRN, and the tag's status (active, inactive, or blacklisted).

- Acquirer Calculates Toll Fare

- Based on the vehicle class and toll plaza data, the acquiring system calculates the fare.

- A debit request is then initiated.

- Debit Request Sent to Issuer Bank

- The acquiring bank forwards the debit request to the FASTag-issuing bank.

- FASTag Wallet Debited

- The issuer bank debits the toll fare from the customer’s FASTag account.

- Customer Notification

- A confirmation message (SMS or app alert) is sent to the user about the debit.

- Debit Status Sent to Acquirer

- The issuer bank informs the acquirer whether the transaction was successful or failed.

- Final Status Sent to Toll Plaza

- The final transaction status is shared with the toll plaza.

- If successful, the boom barrier opens, allowing vehicle passage.

Types of Testing for FASTag Payment Systems

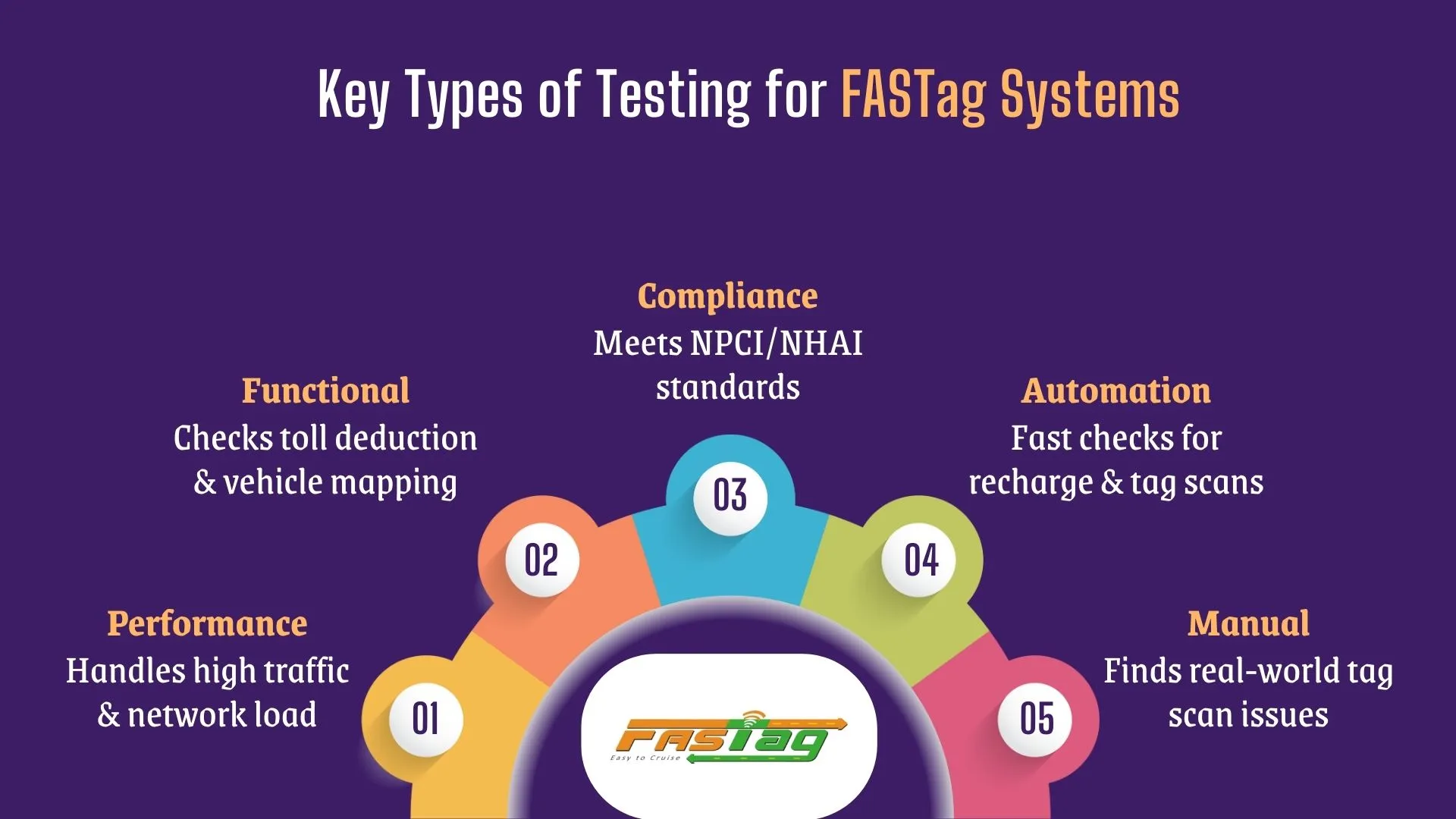

Testing FASTag systems is essential, which covers performance under stress, functional software testing, and compliance management, all crucial for avoiding revenue leakage, delays, and disputes in toll fee payment processing.

Performance Testing to Ensure Transaction Speed

With RFID-based FASTag systems processing thousands of car toll payments daily, performance testing validates how efficiently the system operates under pressure. Using radio-frequency identification (RFID) readers at plazas, the system must instantly identify vehicles via RFID chips and trigger the toll payment deduction.

Key focused testing validations include:

- Maintaining transaction speed during peak hour traffic.

- Avoiding delays in toll fee payment even under severe stress.

- Simulating radio frequency interference or degraded network conditions.

This strengthens digital infrastructure, improves user satisfaction, and supports the rollout of systems like SBI FASTag recharge online and FASTag login portals without performance bottlenecks.

Functional Testing for Accurate Deductions and Validations

In any toll fee payment infrastructure, functional software testing is the foundation of accuracy. FASTag systems must ensure that radio frequency identification tags on each vehicle correctly trigger the toll deduction. This includes checking RFID technology interaction with RFID readers, validation of vehicle class, and integration with payment gateways.

Key validations covered under functional testing:

- Accurate toll deduction for each RFID tag based on vehicle type.

- Testing system behavior on events like FASTag recharge failures or invalid tag status.

- Integration with fraud monitoring systems, like fraud detection systems for anomaly detection.

Service providers like banks and toll operators depend on this phase to ensure accurate deductions, build trust, and meet compliance and audit needs. This also supports smoother workflows for users who want to apply FASTag online through various partners.

Compliance Testing with NPCI and NHAI Guidelines

To operate a secure and scalable automatic toll payment system, strict adherence to regulatory compliance is required. Compliance testing ensures that all systems, whether managed by banks, payment aggregators, or toll plaza operators, follow the specifications laid down by NPCI (National Payments Corporation of India) and NHAI (National Highways Authority of India).

Key areas covered under compliance management and testing:

- Ensuring compatibility with RFID chips approved by government standards.

- Verifying alignment with FASTag transaction flows and API structures.

- Testing whether the toll system supports legitimate FASTag online workflows and redressal protocols.

This testing helps businesses stay audit-ready, mitigate legal risks, and ensure customer confidence across all toll payment options. Whether you’re a banking partner handling a third-party platform enabling FASTag apply online, compliance testing strengthens.

Manual vs Automation Testing in FASTag Systems

As FASTag adoption scales across India, combining manual testing and test automation becomes essential for delivering reliable, scalable, and high-speed toll fee payment services. Testing both modes ensures that the RFID-based infrastructure and fraud detection technology perform seamlessly under real-world stress.

Automation is critical when scaling services like recharge FASTag or validating nationwide FASTag online flows, while manual testing still holds value in real-time testing of radio-frequency identification tag behavior on the ground.

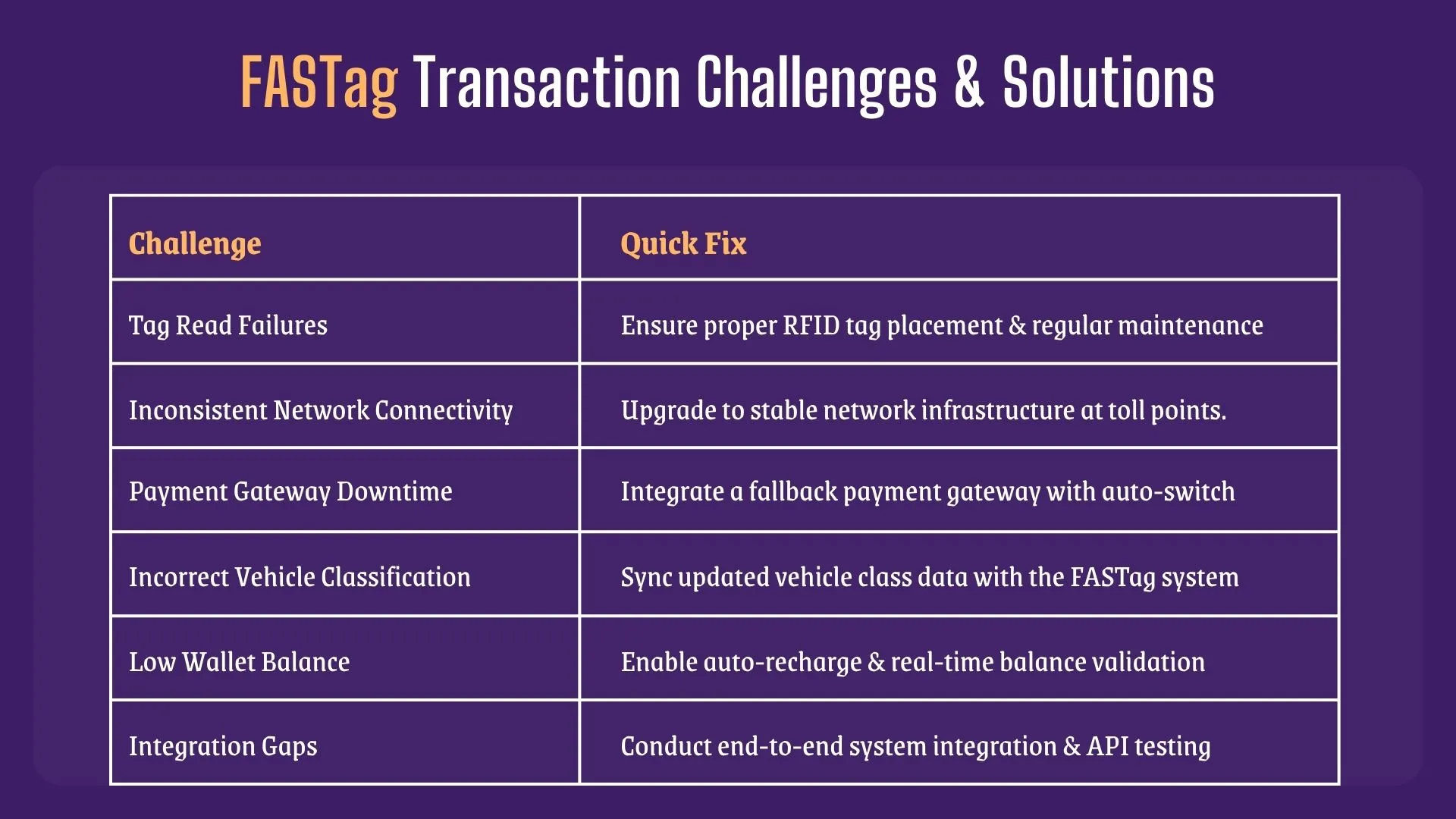

Common Challenges in FASTag Transactions

Despite FASTag being a seamless digital toll collection method, several challenges can affect its performance and reliability in real-time scenarios. Below are some of the key issues commonly observed during FASTag transactions:

- Tag Read Failures: FASTag readers may fail to detect or read the tag due to improper placement on the windshield, dirt, or tag damage, leading to manual toll collection.

- Inconsistent Network Connectivity: Poor or unstable internet connections at toll plazas can delay or interrupt transaction processing, impacting real-time payment authorization.

- Payment Gateway Downtime: Unavailability or latency in payment gateways can cause transaction failures, resulting in toll booth congestion and user dissatisfaction.

- Incorrect Vehicle Classification: Misclassification of vehicles in the system can lead to incorrect toll deductions, requiring manual corrections and causing disputes.

- Low Wallet Balance or Linked Account Errors: Transactions may be declined if the user’s wallet is not sufficiently funded or if there are issues with the linked account

- Integration Gaps Between Systems: Lack of proper integration between the toll plaza infrastructure, issuer banks, and the National Electronic Toll Collection (NETC) system can result in failed or delayed transactions.

Real-World Examples: FASTag Failures and Fixes

Failures in mobile apps, GPS-based tolling, and inconsistent usage patterns have caused toll disruptions. Rigorous testing and QA helped identify root causes and implement fixes, ensuring smooth toll collection and system reliability.

1. Server Downtime Halting Transactions

Widespread FASTag transaction failures due to unexpected central server outages caused severe toll plaza delays, revenue loss, and commuter dissatisfaction.

- Root Cause: Lack of high-availability testing protocols and insufficient validation of critical failover mechanisms during pre-deployment.

- Resolution:

Chaos tools like Gremlin were used to simulate backend failures. Recovery time and uptime were tracked against SLAs. Load testing with Apache JMeter ensured the system could handle real-world traffic spikes after restoration. Redundant server paths and fallback routing were validated.

2. Duplicate Deductions for Single Passes

Users across multiple toll booths reported being charged multiple times for a single toll pass, especially during high traffic hours.

- Root Cause: Faulty RFID reader sync issues and poor coordination with backend services caused repeated transaction triggers.

- Resolution:

Integration testing between toll plaza hardware and the backend system was strengthened. Timestamp verification and session-locking mechanisms were introduced. Real-time logs and alerts were added to auto-detect and prevent multiple deductions.

3. FASTag Not Detected at Plazas

Even with valid FASTags, vehicles were frequently flagged as unpaid due to detection system errors or unreadable tag placements, leading to disputes in transaction history and inefficiencies at toll gates.

- Root Cause: Inconsistent RFID signal strength, misaligned devices, and improper tag placement across various vehicle types affected usage patterns and interoperability systems.

- Resolution: Extensive field test execution across vehicle categories identified optimal tag positions. Reader calibration and firmware updates ensured accuracy. Continuous monitoring tools and data analytics helped capture unread events, reducing detection failures and aiding dispute resolution.

4. Network Failures Causing Transaction Delays

Toll booth transactions often timed out in remote locations due to poor connectivity, disrupting digital payment methods and impacting revenue streams.

- Root Cause: Unstable internet, limited bandwidth, and lack of failover design affected mobile app functionality and slowed real-time toll processing.

- Resolution: Edge caching temporarily stores transaction data. Testing with emulators ensured network resilience. Alternate routing and telecom redundancy ensured a massive reduction in transaction failures and improved efficiency gains in processing transaction fees through scalable systems.

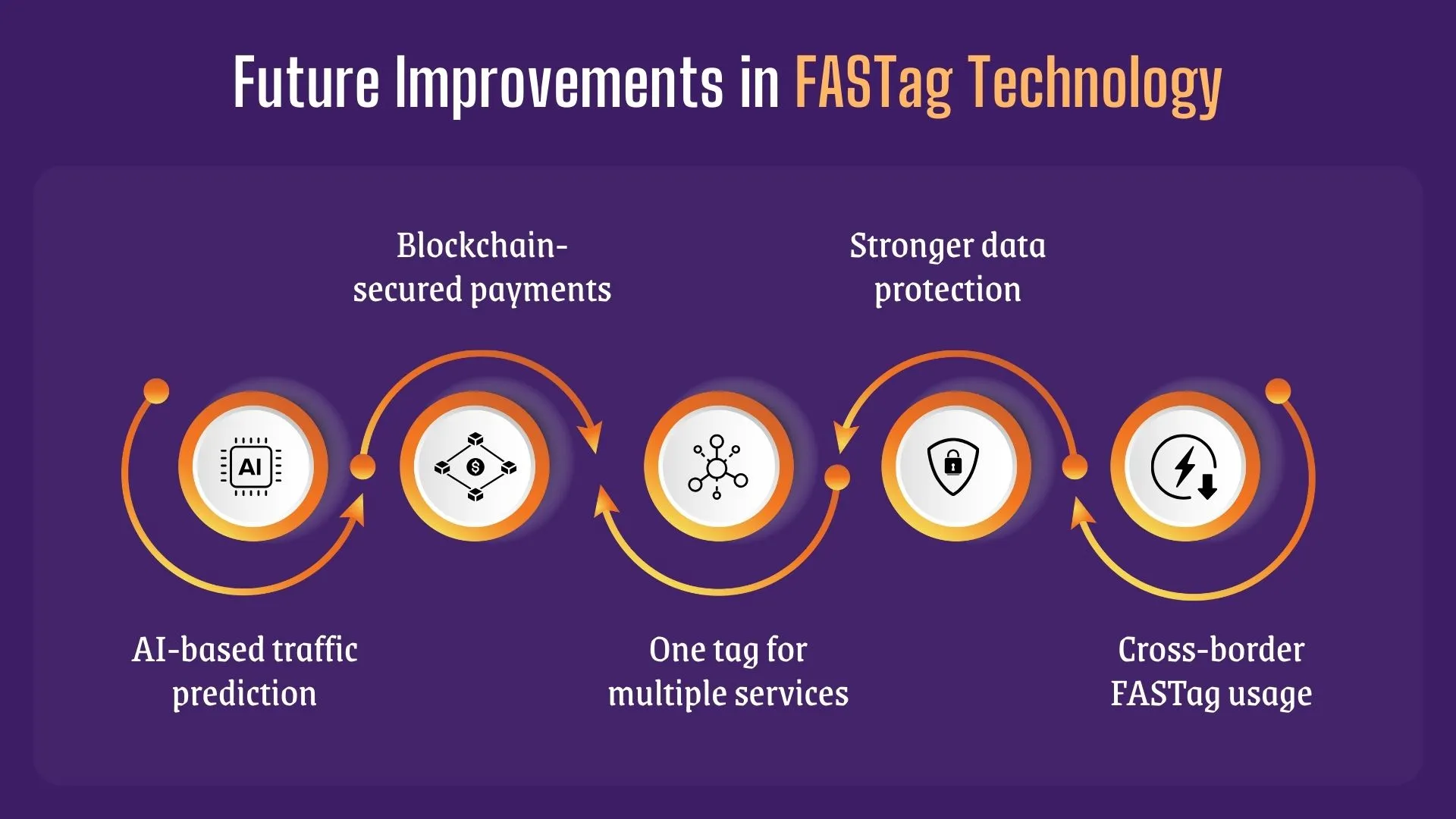

Final Thoughts: Building a Reliable and Compliant FASTag System

A reliable FASTag system supports India's cashless economy through transparent transactions, reduced congestion at toll gates, and efficient revenue collection. By ensuring compliance, test execution, and regression testing, businesses can deliver seamless mobile payment integration and secure transaction history.

Incorporating data analytics and test data management boosts system performance and addresses data privacy concerns. Investing in robust QA helps build scalable toll systems that align with the Government of India's digital payment goals and evolving revenue models.

Frugal Testing, a leading SaaS application testing company, is renowned for its specialized AI-driven test automation services tailored to meet the evolving needs of modern businesses. Among the comprehensive services offered by Frugal Testing are advanced Fintech Software Testing Services, designed to ensure security, performance, and compliance in financial applications. The company also provides cloud-based test automation services, enabling scalable, efficient, and cost-effective testing solutions.

People Also Ask

👉 What does it mean when a FASTag is blacklisted?

It means the tag is inactive due to low balance, policy violations, or being reported stolen. Toll access is denied until it's resolved.

👉Which is better: FASTag or GPS?

FASTag is better for real-time toll collection at fixed plazas, while GPS is suited for distance-based or open-road tolling. Both can work together in hybrid models for improved coverage.

👉What is the difference between NFC and RFID?

RFID works over longer ranges (up to several meters), ideal for FASTag toll detection. NFC works only within a few centimeters, used mostly in short-range mobile payments.

👉Can one FASTag be used for multiple vehicles?

No, one FASTag is issued per vehicle and is linked to its registration number. Using it for multiple vehicles is not allowed and can lead to transaction failure.

👉How secure is FASTag for digital payments?

FASTag follows secure encryption protocols and is backed by banks and NPCI. Transaction data is encrypted, and users can track history through mobile apps for added transparency.

%201.webp)