UPI Autopay is transforming how consumers in India handle recurring payments by allowing automatic debits directly from UPI-enabled apps like Google Pay, PhonePe, and Paytm. Whether it's subscriptions, utility bills, or EMIs, users can set up mandates with secure UPI PIN authentication, reducing the hassle of remembering due dates and making manual payments.

This blog covers how UPI Autopay works, its benefits over traditional methods, real-world use cases, security features, and the underlying technology that powers it, helping users and businesses understand its role in India’s growing digital payment ecosystem.

💡What’s Next? Keep reading to discover:

🚀 UPI Autopay enables automated recurring payments via any UPI payment app

🚀 It simplifies digital transactions for subscriptions, loans, and bills

🚀 Strong security through UPI PIN and multi-factor authentication

🚀 Backed by fintech companies and supported across mobile digital platforms

🚀 How Frugal Testing ensures software systems are robust, reliable, and bug-free?

What Is UPI Autopay?

UPI Autopay is a digital feature introduced by the National Payments Corporation of India (NPCI) that allows users to set up recurring payments via any UPI-enabled app. It eliminates the need for manual transactions, enabling consumers to automate recurring expenses like OTT subscriptions, loan EMIs, utility bills, and insurance premiums.

The feature supports small and large-scale payments, enhancing the convenience of mobile digital payments. Consumers can initiate mandates directly through their preferred UPI payment gateway without depending on debit or credit cards.

Difference Between UPI Autopay and Traditional Payments

Traditional recurring payments are older methods of automating repeated transactions such as EMIs, recurring bill payments, or subscriptions, usually involving manual setup, card linking, or even paperwork. Common examples include:

- Credit/Debit Card Auto-Debits: Scheduled recurring payments deducted from your card each billing cycle via a UPI payment gateway or card processor.

- Standing Instructions (SI): Bank-level digital banking solutions to debit a fixed amount regularly.

- Manual Payments: Requiring user intervention for each UPI payment or bill.

How Does UPI Autopay Work?

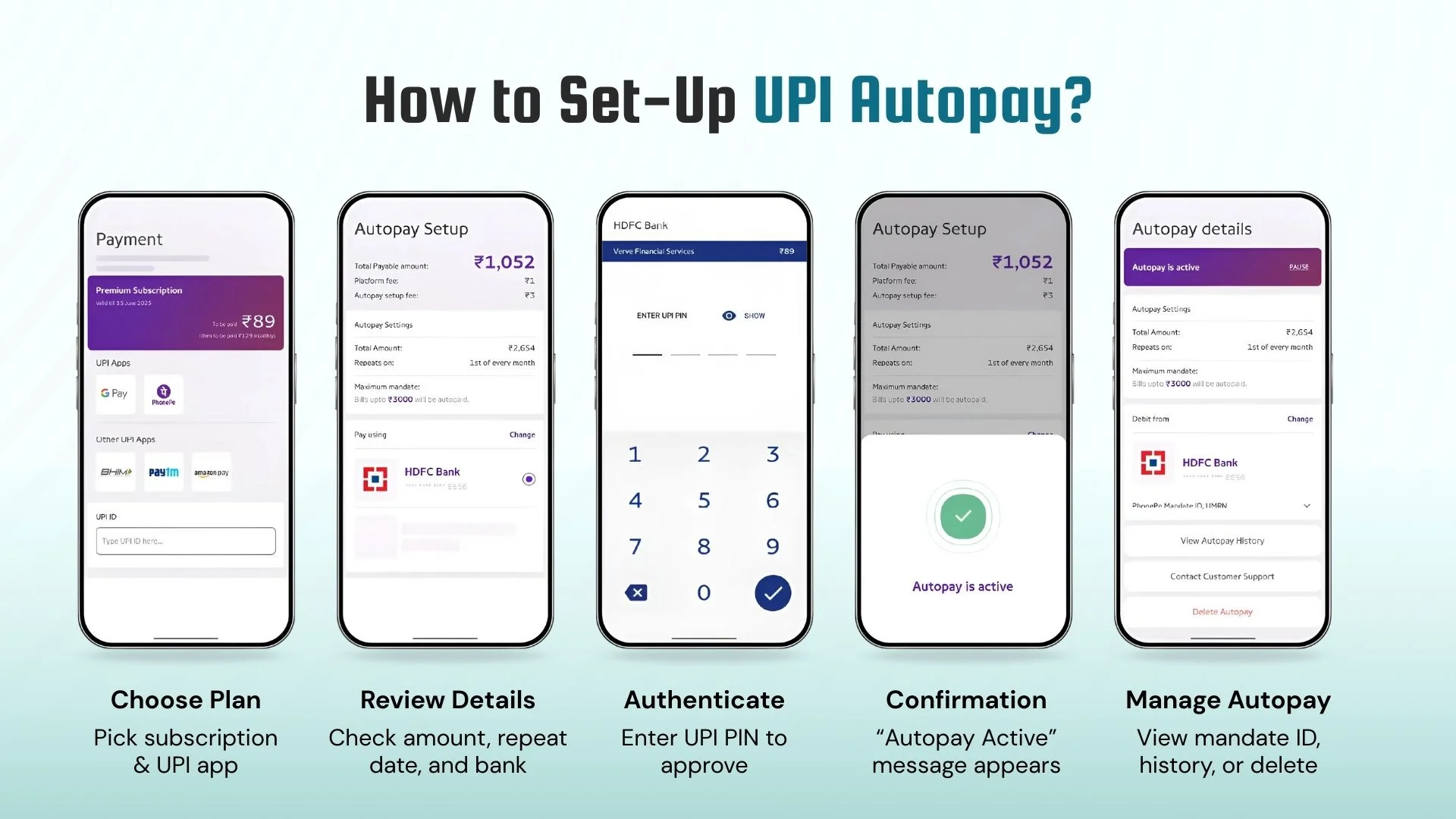

Aiming to streamline recurring collections, UPI Autopay offers a scalable and efficient payment solution. It enables automated debit of payments at fixed intervals, ensuring timely cash flow without manual intervention. Below is a step-by-step breakdown of how it functions from a business integration perspective:

Step 1: Initiation on the Merchant's Platform

This marks the starting point of the UPI Autopay setup process. During a digital transaction on a merchant’s platform, whether it’s for OTT subscriptions, mobile recharges, loan EMIs, or mutual fund SIPs, users are given the option to enable automated recurring payments by creating a UPI Autopay mandate.

- Select UPI Autopay as your preferred payment method through supported UPI payment apps, such as Google Pay, PhonePe, Paytm, and Amazon Pay.

- Define critical mandate parameters:

- Frequency - daily, weekly, monthly, or quarterly cycles

- Amount - fixed or flexible, based on service model

- Duration - specific start/end dates or set to continue “until revoked”

This process is enabled via a secure UPI payment gateway infrastructure and powered by digital banking platforms, ensuring seamless onboarding and enhanced user experience.

Step 2: Mandate Authorization Request

Once the customer finalizes the payment plan, the merchant’s backend initiates a mandate authorization request, automatically pushed to the user’s registered UPI app. This marks the beginning of the authentication and approval process.

- Real-time notifications are sent to the user via direct communication with NPCI (National Payments Corporation of India).

- The system enforces compliance measures such as:

- Multi-factor authentication

- RBI-mandated e-mandate standards

- Embedded data security solutions

This enhances customer confidence, reduces customer service friction, and supports subscription lifecycle management. This capability supports digital transformation in banking, especially for sectors like autopay loans, insurance, and subscription-based billing.

Step 3: User's Authorization via UPI App

Once the mandate request is received, the user is required to authorize it through their UPI payment app, which is activating recurring payments.

Upon opening the request, the user is shown:

- The merchant’s name and UPI ID

- Debit amount and mandate limit (subject to UPI payment limit - ₹15,000 for automatic debits without additional AFA)

- Payment frequency and duration

The user must authenticate using:

- One-time UPI PIN entry

- If required, multi-factor authentication methods like biometrics or device binding

For mandates above ₹15,000, individual debit approvals are required. This secure process ensures valid customer consent, supporting trustworthy digital transaction experiences.

Step 4: Confirmation and Activation

Upon successful authorization, the system instantly registers the mandate and sends the user a confirmation via SMS, app notification, or email. This completes the UPI Autopay setup process.

From this point forward:

- The autopay direct debit setup is fully active

- The merchant can now trigger future payment requests according to the defined mandate

- The user’s selected bank and UPI provider store the mandate securely within an encrypted digital banking platform

This step is essential for automating collections, minimizing manual efforts, and maintaining consistent, reliable billing cycles.

Step 5: Automatic Payment Processing

Following activation, UPI Autopay enables automated recurring payments software to be processed as per the predefined schedule, without any manual input from the user.

On the scheduled due date:

- The UPI system triggers a debit from the customer’s bank account, adhering to the configured frequency and amount

- The transaction is executed in real time using fintech technology solutions and digital banking infrastructure

- Confirmation is sent to the user via SMS or in-app notification

No manual effort is required unless:

- The debit exceeds the UPI payment limit

- A data security breach or failure occurs, in which case the transaction is blocked for safety

This functionality supports enterprises in maintaining consistent revenue, improving billing software accuracy, and enhancing operational efficiency across large customer bases.

Step 6: Mandate Management (Modify/Pause/Revoke)

Enterprises benefit from a flexible and transparent mandate management system, allowing users full control over their payment mandates at any point in the lifecycle.

Users can manage their mandates directly via the Autopay or Mandates section within their UPI apps:

- Pause - Temporarily suspend payments without deleting the mandate

- Revoke/Cancel - Permanently terminate all future debits

- Modify - Change parameters such as frequency, cap amount, or payment source (as permitted by merchant or PSP)

All modifications require re-authentication through UPI PIN, ensuring that data security and authentication protocols are always enforced. Mandates are traceable via sections like “Manage Mandates” or “Payment History,” enabling end-users and businesses to find recurring payments effortlessly.

Technologies Driving UPI AutoPay Functionality

UPI AutoPay uses modern technologies to streamline recurring payments, enhance security, improve mandate management, and boost user experience. Below are the key tools behind its smooth operation.

- Unified Payments Interface (UPI): Acts as the core payment method, enabling instant and automated fund transfers for scheduled payments on a regular basis through subscription-based products.

- E-Mandates Infrastructure: Enables customers to approve mandate registrations digitally, allowing merchants to collect subscription fees without requiring manual intervention, ensuring predictable revenue and steady cash flow.

- Application Programming Interfaces (APIs): Allow integration of UPI AutoPay into e-commerce solutions, improving product adoption and enhancing the overall user experience for subscription business models.

- Two-Factor Authentication (2FA): Secures each payment process using device-level or biometric verification, supporting end-to-end encryption and encryption techniques to ensure transaction safety.

- Cloud Infrastructure (e.g., AWS, Google Cloud): Offers scalability and availability for handling spikes in traffic and processing thousands of scheduled payments efficiently and reliably.

- Database Technologies (e.g., MySQL, MongoDB): Store, manage, and retrieve customer subscription data, payment schedules, and history in real-time to support accurate billing and enhanced customer retention.

- Real-Time Payment Gateways: Facilitate instant validation and confirmation of payments, creating a faster and enhanced checkout experience for both merchants and customers.

- Security Protocols (e.g., SSL, TLS, Tokenization): Secure user data and safeguard manual renewals, mandates, and transactions, reinforcing trust in digital payments and digital banking ecosystems.

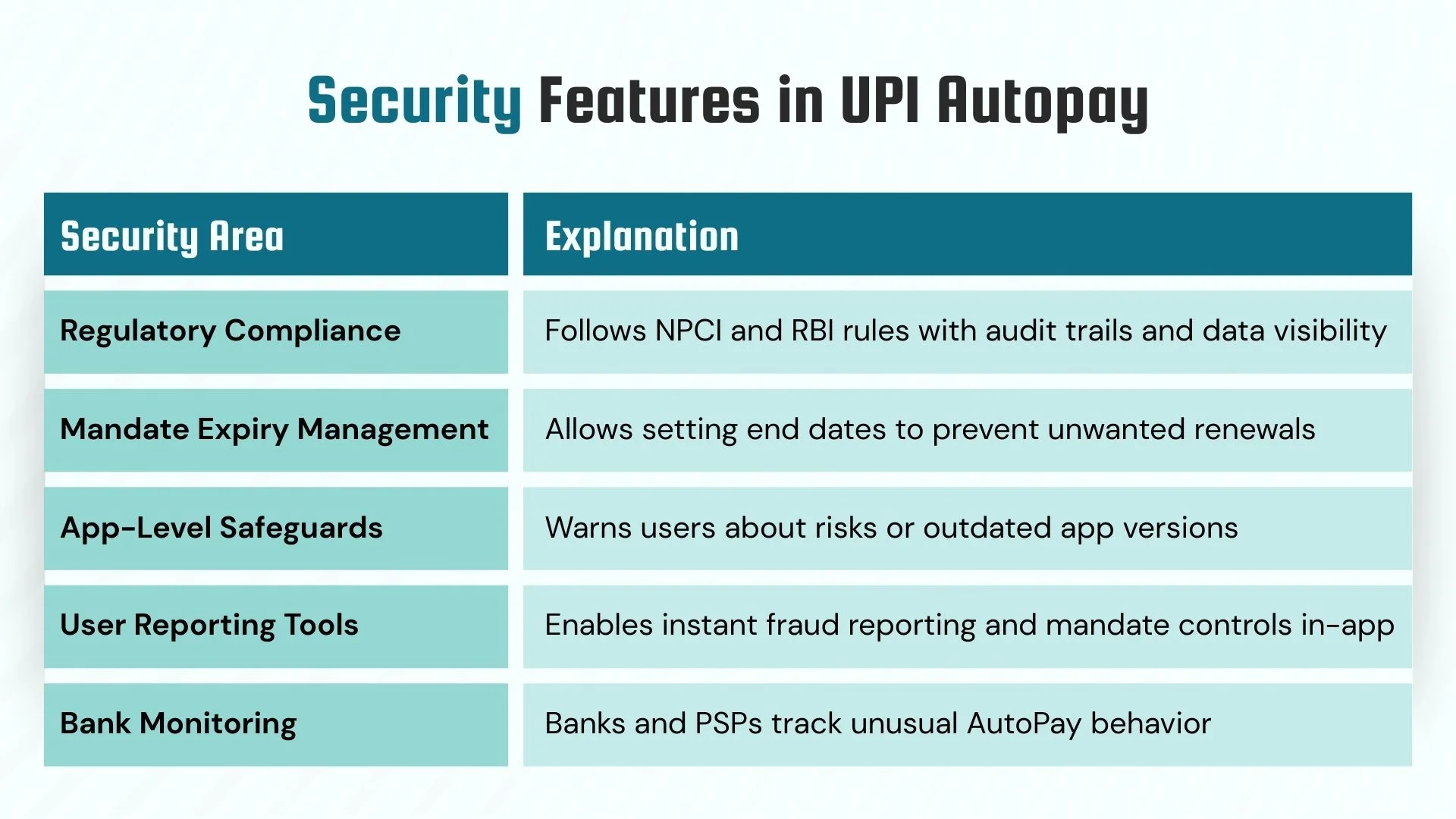

Ensuring Security in UPI Autopay: Protecting Recurring Transactions

UPI Autopay ensures secure recurring transactions through encryption, authentication, mandate policies, user permissions, and strict regulatory compliance, effectively protecting against fraud.

Security Layers and Safeguards:

- Mandate Approval Notifications: Users receive instant alerts when any mandate is created, updated, or canceled, allowing quick action in case of unauthorized activity.

- Mandate Validity Periods: Start and end dates can be configured for each mandate to prevent perpetual billing.

- Transaction Limits: Users can set caps per transaction or mandate, reducing risk in case of errors or fraud.

- Auto-Cancellation Rules: If the balance is insufficient or changes are detected in the mandate terms, the system automatically cancels the mandate.

Real-World Use Cases of UPI Autopay

UPI Autopay simplifies recurring payments across sectors like entertainment, investments, and insurance, making transactions faster, safer, and more convenient through automation.

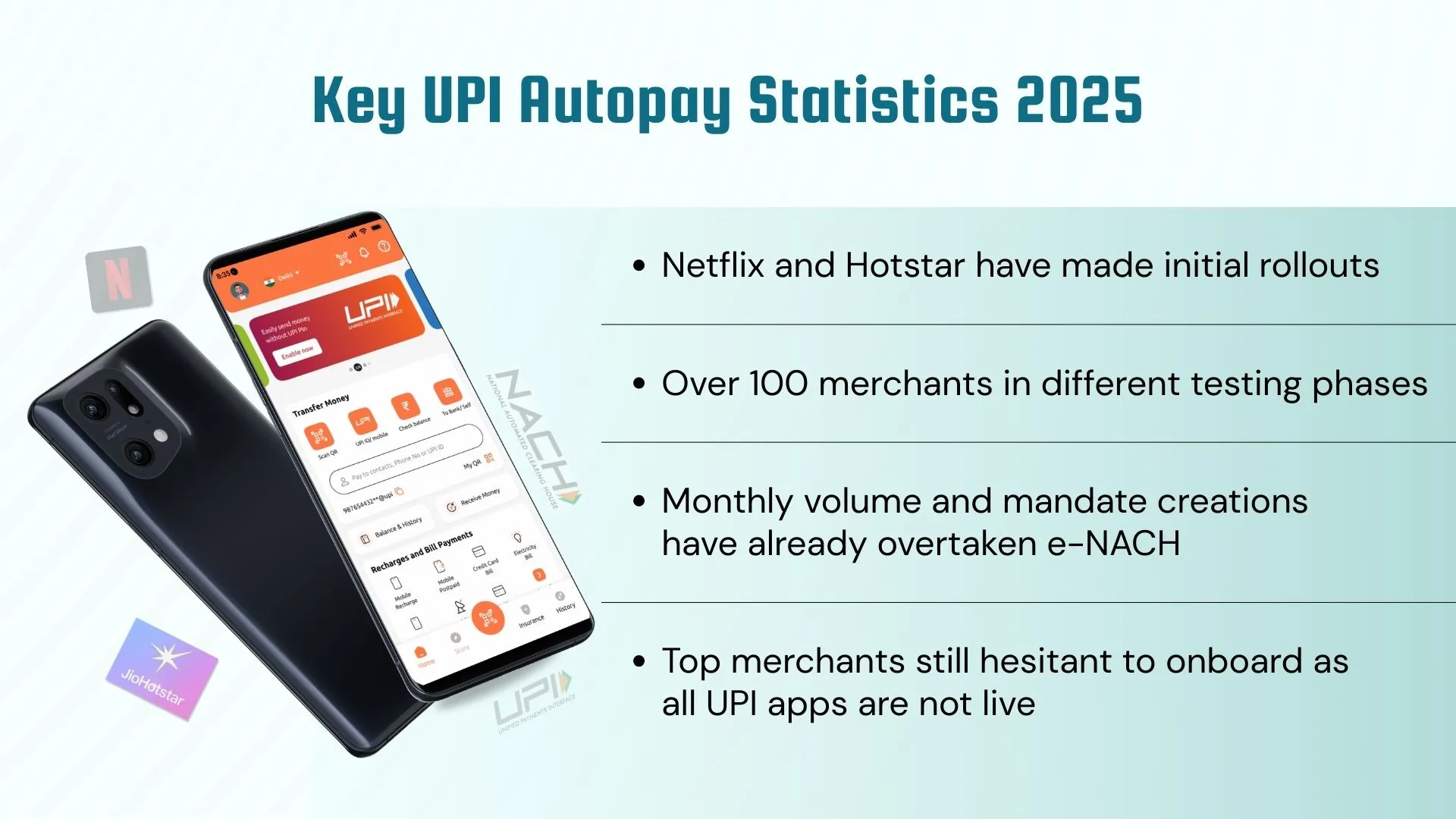

1. OTT Subscription Payments

Streaming platforms like Netflix, Prime, and Hotstar now use UPI Autopay for monthly recurring payments. This eliminates the hassle of manual renewals, enabling smooth UPI payment gateway integration, automated recurring payments, and uninterrupted digital access via UPI payment apps.

- Platform: OTT Streaming Services

- Transaction Type: Subscription Payments

- Payment Mode: UPI Autopay via Mobile Apps

With the rise of digital banking, UPI Autopay ensures hassle-free recurring payments backed by strong data security, seamless autopay, payment reminders, and easy control to stop recurring payments when required. The UPI mandate process keeps it secure and efficient.

2. SIP and Mutual Fund Investments

Investors set monthly SIPs using UPI Autopay, allowing automatic, timely investments without delays or manual actions. This method promotes disciplined savings via recurring payments, automated recurring payments, and fintech software through trusted UPI payment apps.

- Platform: Mutual Fund & Fintech Platforms

- Transaction Type: Monthly Investments

- Payment Mode: UPI Autopay Mandates

Recurring payments through UPI offer convenience, speed, and reliable contributions backed by strong data security software, UPI mandates, and digital banking. Users can easily manage, track, or stop recurring payments using UPI payment gateways within investment platforms.

3. Insurance Premium Payments

Policyholders automate premium payments using UPI Autopay, avoiding due-date stress and manual steps. This approach improves compliance, reduces lapses, and leverages secure UPI payment systems with automated recurring payments and smart subscription billing alerts.

- Platform: Insurance Companies

- Transaction Type: Premium Payments

- Payment Mode: UPI Autopay

UPI Autopay brings safer recurring payments with verified data security, flexible payment reminders, and full control to stop recurring payments if required. Integrated through secure UPI mandates, it streamlines operations across insurers and digital banking apps.

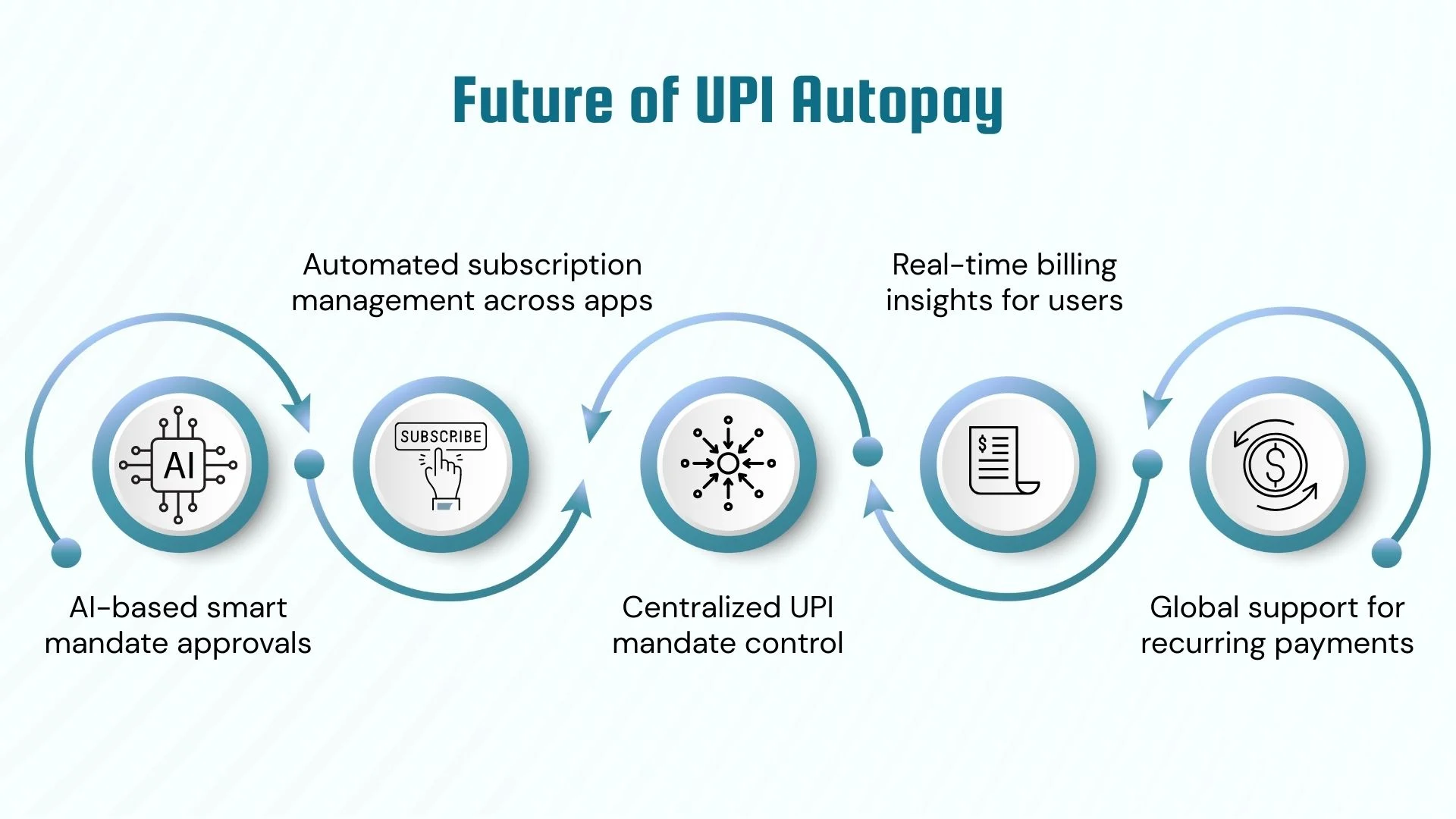

Conclusion: The Future of Recurring Payments

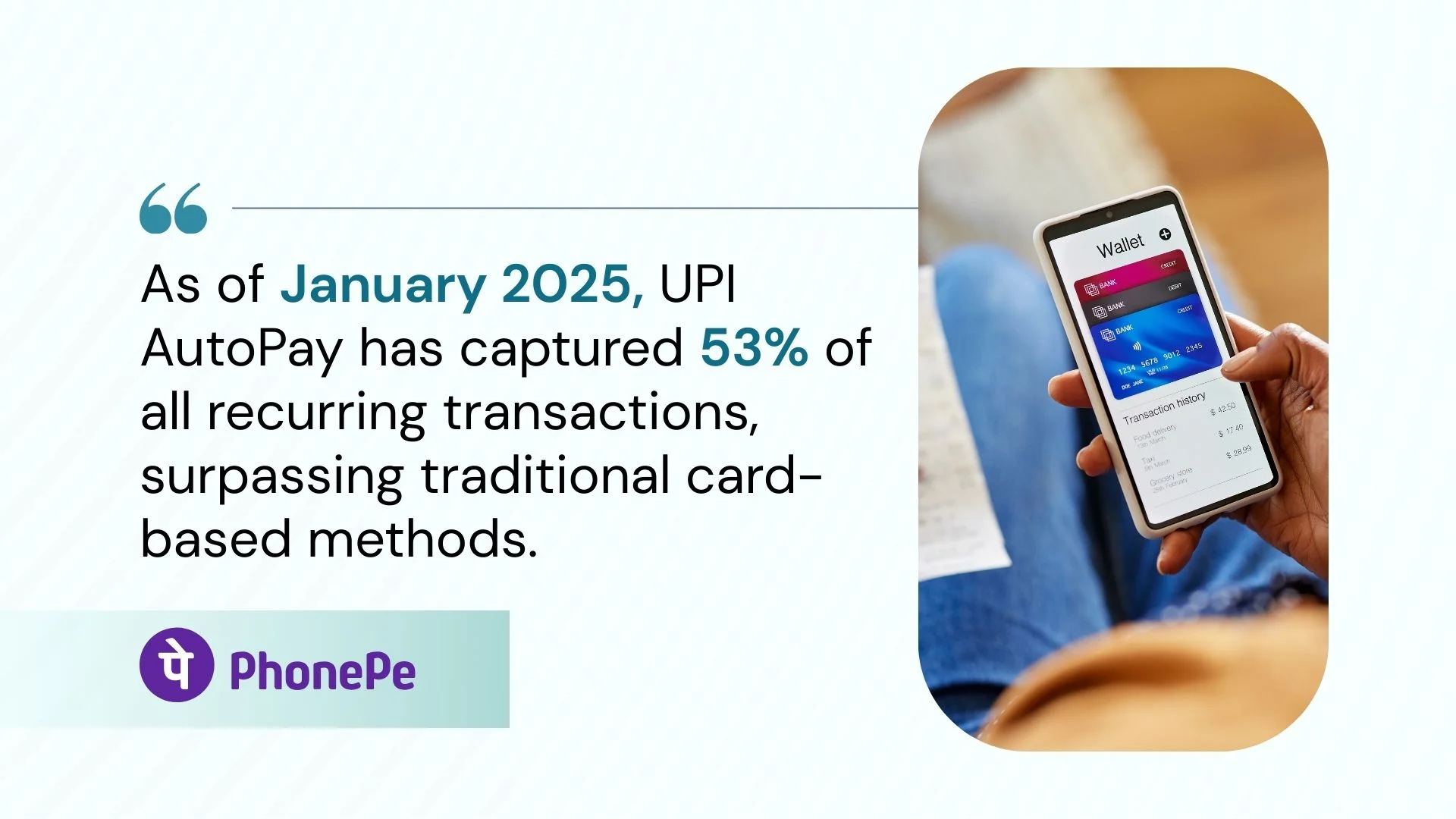

UPI Autopay is reshaping recurring payment management in India by enabling real-time mandate approvals, secure automated transactions, and seamless system integration. This helps businesses reduce manual effort, avoid payment delays, and ensure consistent revenue flow and timely revenue recognition, critical for subscription-based and installment models.

As adoption grows across banks, fintechs, and enterprises, UPI Autopay is becoming integral to India’s digital payment ecosystem. Automating the entire subscription lifecycle enhances customer experience, streamlines operations, and improves financial accuracy and compliance for businesses.

Frugal Testing, a leading SaaS application testing company, is renowned for its specialized AI-driven test automation services tailored to meet the evolving needs of modern businesses. Among the comprehensive services offered by Frugal Testing are advanced Fintech Software Testing Services, designed to ensure security, performance, and compliance in financial applications. The company also provides cloud-based test automation services, enabling scalable, efficient, and cost-effective testing solutions.

People Also Ask

👉Is OAuth used in the UPI Autopay authorization flow?

No, OAuth is not used in the UPI Autopay authorization flow. UPI Autopay uses the UPI intent or collect request via PSP apps, where the user authenticates the mandate using their UPI PIN through the UPI app interface.

👉How to enable recurring payments in Google Pay?

In Google Pay, recurring payments are enabled through UPI Autopay mandates. Merchants integrate with the UPI Autopay API, and users approve the mandate by verifying it in the Google Pay app using their UPI PIN.

👉What is the transaction limit for setting up UPI auto mandates?

As per NPCI guidelines, UPI Autopay allows setting up mandates for transactions up to ₹1,00,000. However, mandates above ₹15,000 often require additional AFA (Additional Factor of Authentication) per transaction.

👉How to set up automatic payments from customers?

Businesses must integrate with the UPI Autopay API via a certified PSP. Customers can then authorize mandates through their UPI apps. Once authorized, recurring debits occur automatically as per the mandate schedule.

👉What happens if a mandate fails due to insufficient balance?

If a mandate fails due to insufficient balance, the transaction is declined, and the merchant is notified. Some PSPs offer auto-retry mechanisms or send reminders to customers to add funds and retry the debit.

%201.webp)